Stablecoins have become a significant foundational piece for the cryptocurrency sector because they serve as a deeply liquid base pair for most assets and also offer investors a secure place to capture gains. Data also shows that stablecoins play a significant role in functioning as a gateway for capital inflow to the crypto ecosystem.

While the largest stablecoins in the market are currently controlled and issued by centralized entities like Tether or Circle, DAI and its issuer Maker (MKR) is one stablecoin project that keeps with the ethos of decentralization that the cryptocurrency community is founded on.

Data from Cointelegraph Markets and TradingView shows that the price of MKR has increased by almost 100% in the past week, rallying from a low of $2,011 on April 7 to a new all-time high at $4,096 on April 15 on surging trading volume.

Momentum for MKR has been on the rise in recent weeks as the ecosystem thanks to a focus on making the protocol fully decentralized and community governed.

Governance has emerged as one of the sought-after features in the 2021 bull market as part of the wider decentralized finance (DeFi) movement, and MakerDAO provides one of the most active governance experiences across the crypto sector.

As the community prepares for complete decentralization, these are the key components for creating a self-sustaining MakerDAO:https://t.co/BgrvGUvci2

— Maker (@MakerDAO) April 3, 2020

Holding MKR is required in order to participate in the governance of the protocol and the increasing number of governance proposals to vote on has led to a higher demand for MKR, pushing its price higher.

Demand for DAI boosts Maker price

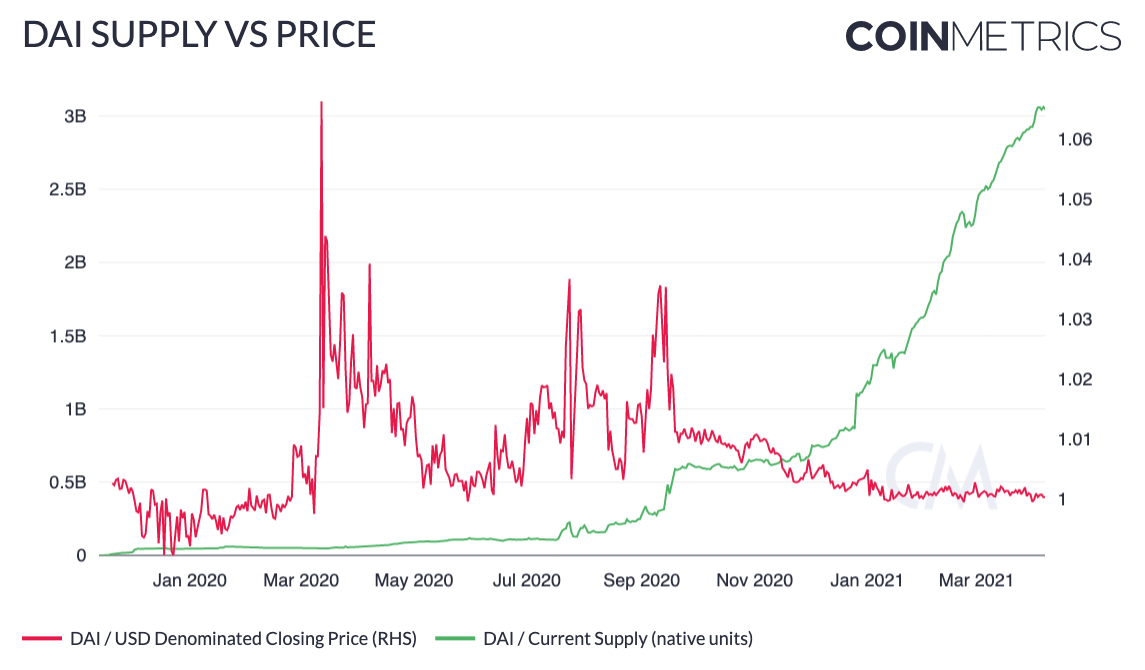

As previously mentioned, one of the primary tasks of MakerDAO is to govern the DAI stablecoin, which has seen significant growth in its total supply in 2021 as the algorithmically controlled stablecoin became better at maintaining its peg to the U.S. dollar.

The growth in the supply of DAI is in part due to its use across a number of DeFi protocols including AAVE, Compound (COMP) and Cream Finance (CREAM) as the go-to option for a decentralized stablecoin.

New DAI are created by locking collateral like Ethereum (ETH) or ChainLink (LINK) into a MakerDAO vault and generating DAI against it.

Due to this mechanism, the rising supply of DAI has coincided with a surge in the total value locked (TVL) in the Maker protocol which has made the project the second-ranked DeFi protocol behind Compound which has a $9.28 billion TV.

As the TVL on MakerDAO steadily climbed alongside the rising supply of DAI, fundamental indicators including increases in social media activity began signalling an approaching price move.

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for MKR on April 13, prior to the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

As seen in the chart above, the VORTECS™ Score for MKR climbed into the green on April 12 and reached a high of 80 on April 13, around 31 hours before the price rallied 65%.

With altcoins now on the move again and the DeFi sector heating up as evidenced by rising TVL across the ecosystem, MakerDAO could rally further as it is the go-to choice for investors looking to interact with Ethereum network-based DeFi protocols.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.